- March 1, 2022

- Posted by: principlegroup

- Category: Uncategorized

As an accounting firm, you are continuously looking to grow your business. The competition is tough and, in an accounting landscape ravaged by the pandemic, you need to do more with less. There is a downward price pressure exerted by clients who are feeling the pandemic pinch and want your firm to offer more value (through more work), for the same price.

Some might ask you to lower prices for services that might already be at the lower end of the scale. You might not be earning the same high margins for the accounting and bookkeeping work you did earlier.

Therefore, you must look for strategic alternatives that can deliver respite from the challenges you face and interfere with your growth prospects.

But, first, a look at the challenges your firm is expected to face in 2022.

KEY CHALLENGES IN 2022

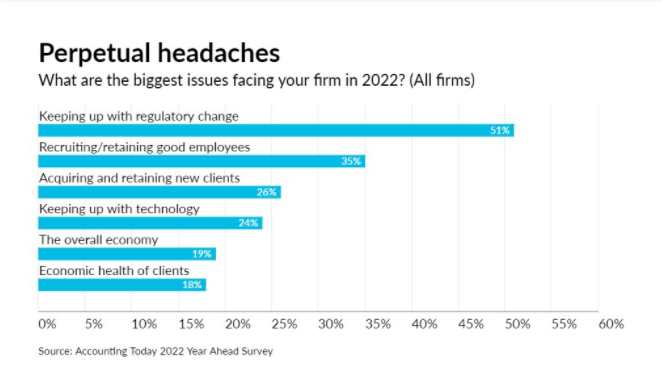

Not all challenges will hit closer to home, but challenges like recruitment, client retention, and acquisition are common amongst all firms.

There is very little doubt that talent shortage is a big problem in the accounting industry. There are plenty of factors influencing this shortage, and firms face its brunt, especially the small and mid-sized firms.

A demand and supply problem (more demand, less supply) means that firms face a candidate-led market, wherein highly qualified accounting professionals are in great need. These are typically snapped up by the more prominent firms who can promise a clearer and better career progression and a fatter pay packet.

This results in the smaller firms not getting their hands on the professionals they need. They are constantly short-staffed, which impacts their productivity and ability to grow.

The result is stagnancy.

Also, clients are demanding more advisory services from accounting firms as they try to find their way around regulatory changes. Again, it’s not as if firms do not want to transition to a more advisory role, and the problem is that of time and lack of capacity.

But there is an answer, and it is very simple – Outsourced accounting.

OUTSOURCE ACCOUNTING TO BUILD LONG TERM CAPACITY, QUICKLY

If your firm has to compete with the bigger players in the accounting space, it needs to become more productive, move the needle on high-margin services that build reputation, and keep growing. The last involves focusing energies on client acquisition and continuously adding to your client list, especially strengthening it with marquee clients.

This is where accounting outsourcing helps bring a range of benefits to your firm:

Scale Team Quickly and Flexibly:

When you outsource accounting services, you are essentially accessing outsourced accountants who act as an extension of your team. They are well-trained in US accounting standards and can work independently. You don’t have to go through a lengthy recruitment cycle to add accounting professionals to your team. This happens quickly and seamlessly. What’s more, you have the flexibility to scale up or down as per the work coming your way.

The Advantage of a Full-Time Equivalent (FTE) Accountant:

Imagine hiring an accountant who comes with many years of accounting experience, is well-versed in GAAP and proficient in a range of accounting tools; and this hiring comes at a very affordable price. Also, this accountant works for your firm full-time but isn’t on the payroll and doesn’t add to your infrastructure costs. Sounds like a dream isn’t it. An outsourced accounting firm, experiences this advantage. Your firm can build a team of accountants who work out of an offshore delivery center, but are as good as a part of your internal team. The only difference is that they come at a far lower price than the salary you are paying your internal employees.

The Cost Advantage:

Outsourcing helps you lower your operational costs as you do not have to spend on the salary and its various associated components. You also save on infrastructure costs. In the beginning of this article, we talked about the ‘downward price pressure,’ and outsourcing accounting will help you offset this pressure. In fact, you can actually earn more, and put economies of scale to good use to boost profits. Some of this cost-saving can be passed on to your clients. Also, in the case of marquee clients, you can probably win them over by lowering your prices if a substantial amount of work is being promised regularly. You know you have a team to handle all this work coming your way, that can be scaled very quickly and effortlessly.

ACCOUNTING OUTSOURCING IS A STRATEGIC INITIATIVE

As far as business initiatives go, outsourcing must be seen through a more strategic ‘business-growth’ prism. Yes, there is no doubt that it helps you build capacity at far lower costs, but think of these two benefits with a long-term outlook.

Seasonal outsourcing is not a bad business model, but a long-term approach delivering even more value to your firm. Think about a team of FTEs who are providing accounting and booking services to your firm. Over time, this will allow your firm to take up a more advisory role for your clients.

This will power firm growth and help you compete with bigger players in the niche without putting pressure on the overheads. Most accounting outsourcing services providers, the good ones, will work with you to create and implement a strategic growth plan powered by outsourced accountants.

Therefore, you can grow your firm’s profile in the audience group that matters. Outsourcing also allows you to plan ahead for addressing any future challenge that your firm might encounter. This helps you plan better, which ultimately boosts your firm’s growth.

CONCLUSION

Your firm’s capacity to do more accounting work directly depends on how fast you can scale. This becomes a problem in an industry that is battling a talent shortage. Accounting outsourcing emerges as the #1 option to address your scalability needs.